“Mania,” “craze,” and “frenzy,” are some choice terms to describe the market sentiment which swirled around certain blockchain projects during 2017. They caused people to buy Ethereum—the coin of choice for these projects—in droves, and many reached nosebleed valuations based on little more than promises. The particular class of projects which experienced such surging demand time was known as the Initial Coin Offerings or “ICO” for short.

If that term sounds similar to “IPO” – an acronym from traditional markets which refers to an Initial Public Offering – the similarity is intentional. An IPO is the process through which a company “goes public,” or gets listed on a traditional stock exchange so that the public can purchase shares in the company. An ICO is a crypto fundraising process, a bit like a Kickstarter.

An ICO differs from an IPO in several significant ways:

-

Companies or projects which ICO (the term can be used as a verb) aren’t listed on traditional stock markets. Instead, investors or speculators receive crypto tokens (usually in the form of ERC-20 tokens associated with their Ethereum account) instead of shares. Unless specified in the token contracts, these tokens don’t convey voting rights, dividends, or any of the legal protections of regular shares. In most cases, such tokens were only symbolic of the company or project’s fortunes.

-

ICO tokens were (and are) usually sold only for other cryptocurrencies, most commonly Ethereum and Bitcoin, especially during their pre-sale phase. Such tokens were only occasionally sold for fiat if they were listed on exchanges with fiat support, which only a very small percentage of all ICOs achieved. The demand for ICO tokens thus created a strong incentive to buy Ethereum and Bitcoin, which boosted the late 2017 / early 2018 crypto bubble, during which most cryptocurrencies reached all-time highs.

-

Unlike conventional stock offerings, ICO tokens were (and, in some jurisdictions, still are) unregulated. Financial regulatory agencies in most countries now recognize that ICOs constitute securities. Securities are financial instruments which people purchase with an expectation of making profit, which must be regulated. Before this classification, many early ICOs were able to raise enormous sums outside of any sort of regulatory framework. This led to a lot of bad outcomes…

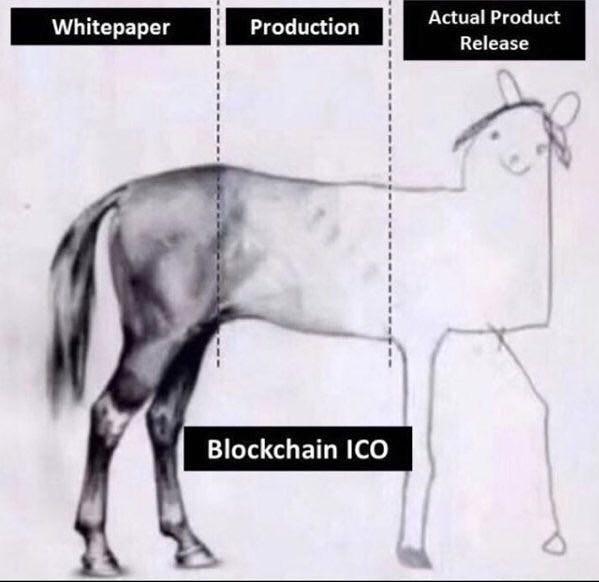

At the peak of the ICO mania, people were throwing money at anything calling itself an ICO. All sorts of madcap crypto projects were launching right and left. Shady blockchain projects raked in millions of dollars with little more than a website and a white paper. If these projects even bothered to subsequently release working code, the results were generally disappointing…

In late 2018, the failure rate of ICOs was estimated at 86%. Something like 9 out of 10 ICOs were abandoned, failed, or turned out to be fraudulent. Despite the ICO hype, a high failure rate was predictable given that 75% of all startups fail within 15 years. The reasons for the ICO failure rate well in excess of this standard are legion, but beyond the scope of this article.

Suffice it to say that the market has learned some costly lessons. In countries where ICOs are regulated, the authorities will prevent the recurrence of any ICO mania, insofar as they’re able to meaningfully restrict the flows of cryptocurrency.

Some of the blockchain projects which remain, now that most of the dumb money and the scammers that prey upon it has been washed out, are actually pretty impressive. If they succeed, they may redeem the promising concept of funding via decentralized cryptocurrency.

ICOs showed just how much money can be raised by opening investment to the whole world, what’s needed to realize that potential are some sensible rules to ensure proper outcomes.

Will people buy Ethereum again? The next big things in crypto

What remains of the ICO market is a far more sensible and realistic approach to decentralized finance or DeFi, as some have taken to calling it. This buzzword refers to performing traditional functions of finance on the blockchain. While some argue that Bitcoin is the quintessential example of DeFi and that any further applications can be built atop Bitcoin, there are certain innovations which work better either on Ethereum or as standalone products.

Recently, we’ve also seen the emergence of Initial Exchange Offerings or IEOs, as an alternative to ICOs. The major difference is that IEOs are conducted entirely within an exchange. In theory, the exchange will vet the project and allow only authorized users to buy in. IEOs are also easier, as the exchange handles all the technical operations once users have elected to purchase IEO tokens.

Finally, STOs or Security Token Offerings, are fully-regulated shares or IPOs conducted via blockchain technology rather than traded on a regular stock exchange. While this concept has much to recommend it – such as quicker trading times and an immutable record of transactions – it ultimately depends on regulatory approval. This is likely to come in time as regulators are slowly getting to grips with cryptocurrency.

Trendsetting Blockchain Projects?

We’re not saying that any of these particular blockchain applications heralds the return of a bubble comparable to the ICO mania. However, the re-emergence of a crypto bubble at some future point seems inevitable. Part of that bubble is likely to flow into some sector of the crypto economy which does away with traditional limitations. After all, cryptocurrency allows people to shortcut regulations, which is both good and bad…

Skirting regulation is positive in the sense that those making the rules at the highest level tend to do so for self-interested reasons. Retaining or extending their monopoly over money and economic control is clearly the priority, rather than ensuring the general monetary situation is optimal.

The negative side of such disruption is that all the protective regulation put in place in response to decades of fraud and failure is done away with. Most people just aren’t used to operating in such a risky environment and soon suffer the financial consequences.

While we don’t recommend for or against investment in any of the projects, here are some of the more theoretically promising ones we’ve noticed:

#1. Decentralized Finance: Bitcoin Enhanced (CBE & XBE)

While Bitcoin Enhanced might sound like just another forkcoin, it’s actually far more interesting than another Bitcoin clone. Unlike typical ICO blockchain projects, Bitcoin Enhanced works on the Waves platform and is only traded over the Waves decentralized exchange. This makes Bitcoin Enhanced quite unique, as most DeFi projects require you to buy Ethereum for access.

As an example of an interesting DeFi application, Bitcoin Enhanced functions similar to a hedge fund… the difference being that all its operations are automated via smart contract. The token’s developers developed a trading algorithm, known as Phi, which proved successful in commodities and Bitcoin trading. The Bitcoin Enhanced token was designed as a way for investors to gain exposure to the Phi algorithm without any of the usual restrictions and regulations associated with hedge funds traded over traditional markets.

The algorithm is fairly simple; it takes a long position in Bitcoin but exits the market when it forecasts an imminent dip. Since Bitcoin Enhanced was launched, this strategy has proven about twice as profitable as simply buying and holding Bitcoin. One benefit of their approach is that unlike Bitcoin futures or derivatives traded on traditional markets, there’s no linkage between Bitcoin Enhanced and the traditional financial / fiat / taxation system.

Bitcoin Enhanced is a synthetic, meaning it has no direct linkage to the underlying asset either: Bitcoin in this case. This contrasts with say, Bakkt’s upcoming futures market which is backed 1:1 by real Bitcoin. As discussed above on the topic of regulation as a double-edged sword; this opens financial products like hedge funds to everyone in the world but also presents new risks. Bitcoin Enhanced is certainly an interesting approach, which could lead to an explosion of similar ventures in the years ahead.

#2. Initial Exchange Offering: Unus Sed LEO Tokens (LEO)

LEO tokens were launched on the Bitfinex exchange and raised an impressive $1 billion. This total is particularly notable given that the IEO only ran between the 5th and 13th of May this year. For comparison, a study released in October of 2018 estimated that ICOs had raised a combined $20 billion.

Unus Sed LEO was created by Bitfinex as an “exchange token,” which benefits users of the exchange primarily by reducing their fees for common exchange operations: trading, lending, withdrawal, and deposit.

Each LEO token is currently worth $1.19, which is a 19 cent (or percent) gain over the initial sale price of $1. The total market cap of these tokens is $1.18 billion. It was sold only to persons registered with Bitfinex for compliance reasons. It works as an ERC20 token on the Ethereum blockchain, so to make use of it you’ll need to buy Ethereum; a small amount is all you need for the LEO contract’s gas costs.

The massive amount raised by this token, and similar amounts for other exchange coins, suggests that major crypto companies are well-positioned when it comes to fundraising. Instead of trying to get listed on traditional markets and having to comply with a lot of regulation and pay a financial firm to conduct their IPO, crypto companies have the expertise to issue their own IEO tokens. Exchanges are particularly well-positioned here, as they can keep everything in-house.

As for the token’s strange name, it’s a quote in Latin from one of Aesop’s fables.

#3. Security Token Offerings:

tZERO is an interesting development from Overstock, one of the earliest online retailers to accept Bitcoin. They aim to establish a regulated and compliant platform on which STOs can be launched in future. As the STO market is still nascent, the current drive is to establish a solid STO platform. Another strong contender is Polymath.